Investor Activity Explained: What Buyers Need to Know

You’ve probably seen the headlines: “Big investors are buying up all the homes.”

If you’ve lost out on a few offers, that claim can feel very real. But the data tells a different story.

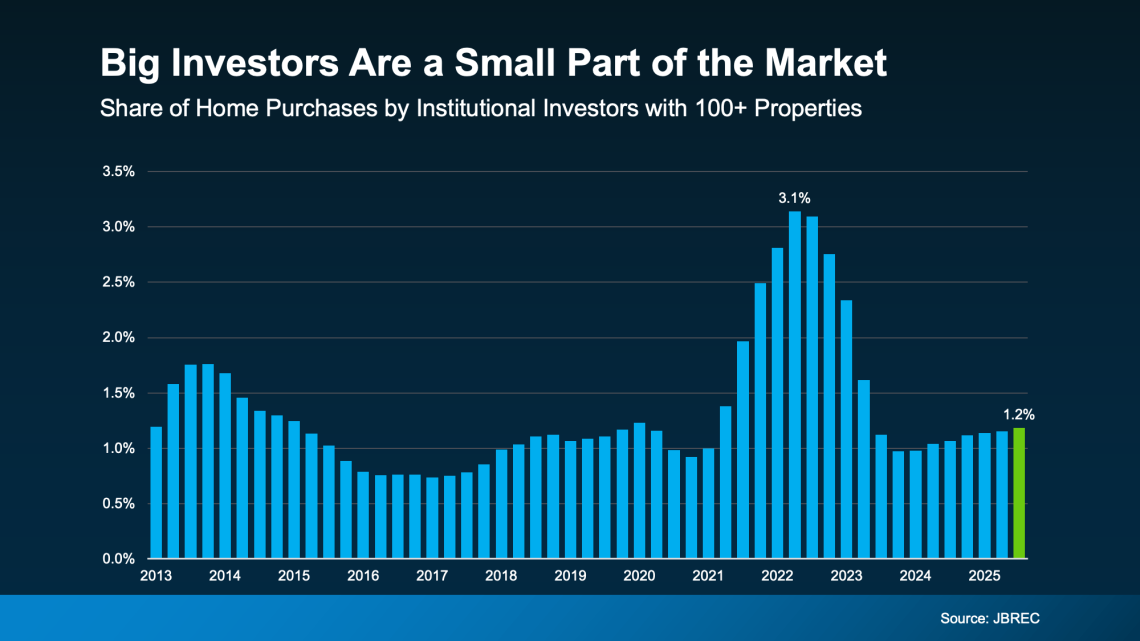

According to John Burns Research & Consulting, large institutional investors (those owning 100+ homes) made up just 1.2% of all home purchases in Q3 2025. That means out of every 100 homes sold, only about one went to a large investor. Even at their peak in 2022, they accounted for just 3.1% of purchases.

So why does it feel like investors are everywhere?

First, investor activity isn’t evenly spread. In certain markets, they’re more visible, which can make competition feel intense. Second, many headlines lump big Wall Street firms together with small, local investors — like individuals who own one or two rental properties — making the numbers sound much bigger than they are.

The reality? Most investors are local, small-scale owners. And the biggest affordability challenges today aren’t driven by large institutions, but by limited supply, strong demand, and years of underbuilding.

Understanding the difference between perception and reality can make a big difference when deciding your next move.

We're Here to Help

The real estate market can always be challenging, no matter the current interest rate or home inventory levels. We're here to help you navigate the changing market. We'd love to talk about your goals and how we may be able to help.