Mortgage Rates Are Dropping. What Does That Mean for You?

It's time to get excited! Mortgage rates have been a hot topic in the housing market and have risen dramatically over the past 12 months. But now, they’re dropping, and that could mean big things for you as a home buyer!

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains it well by saying:

“Mortgage rates dropped even further this week as two main factors affecting today’s mortgage market became more favorable. Inflation continued to ease while the Federal Reserve switched to a smaller interest rate hike. As a result, according to Freddie Mac, the 30-year fixed mortgage rate fell to 6.31% from 6.33% the previous week.”

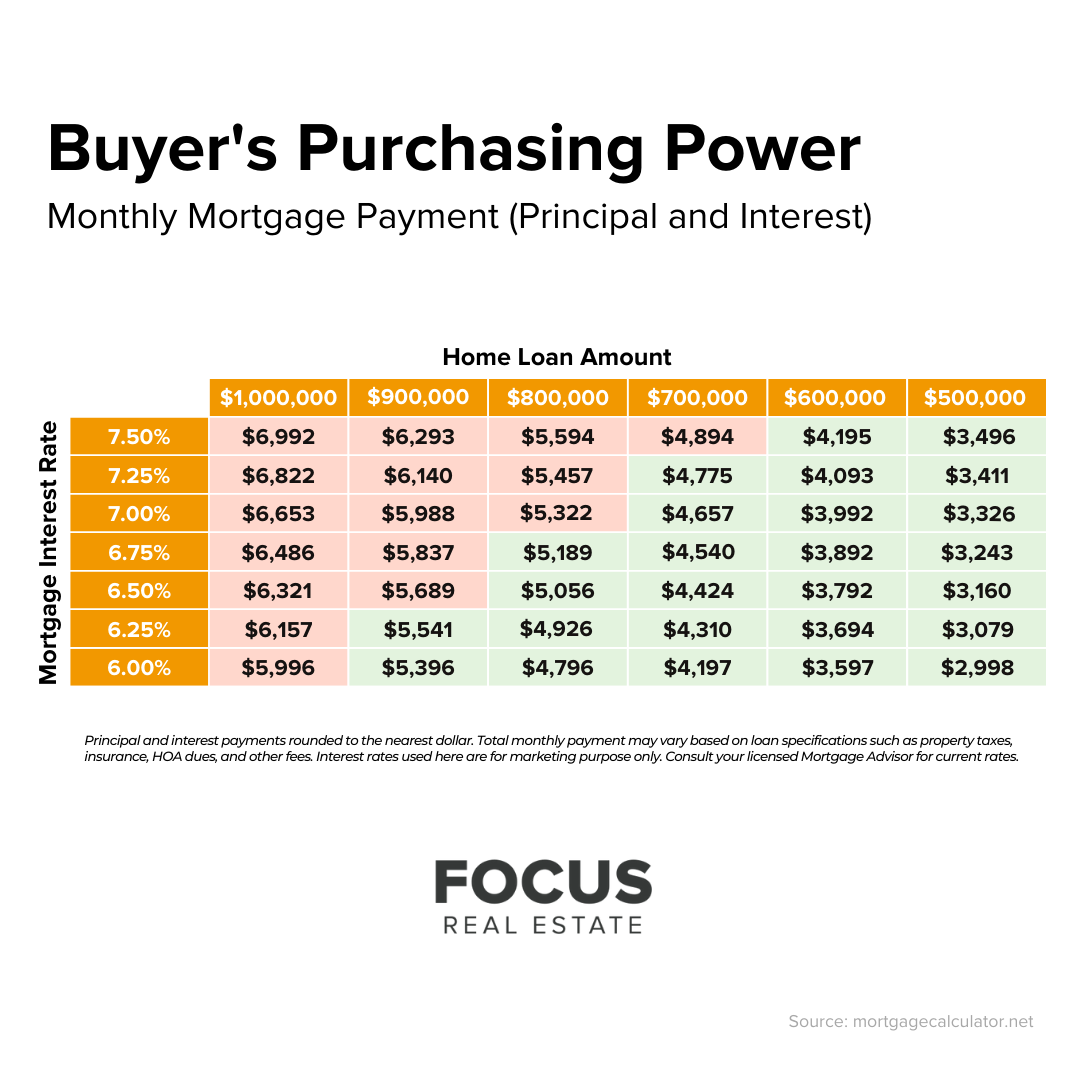

Even small fluctuations in mortgage rates can make a big difference. Lower interest rates mean lower monthly payments and more money saved over the life of your loan. It also allows you to purchase homes at higher prices as compared to higher interest rates, making homes more affordable overall.

According to the Greater Boston Association of REALTORS® the median-priced home in Boston is $710K. If you're looking for something in the $600,000 range, understanding how mortgage rates can affect your purchasing power can help you make the right financial decision.

Check out this chart below to see how increasing or decreasing mortgage rates can change your monthly payment if you want it to stay around $4,000- 5000 or below. Orange means that a payment is over that limit, and green means that it is within your target range.

.png?w=1140)

When considering the purchase of a home, it’s important to keep an eye out for small fluctuations in mortgage rates. Even a small change of 0.5% can have a big effect on your monthly payment. This is why it is important to get advice from a real estate expert.

Conclusion

We know that when it comes to finding the right mortgage rate, every little bit counts. That’s why it helps to stay up-to-date on current mortgage trends and talk with a lender about the best rate available.

The housing market can be unpredictable, and mortgage rates may fluctuate depending on inflation. However, if you’re aiming for a specific monthly housing expense, now could be an ideal time for you to explore your options and see what kind of rate you qualify for.

We know that when it comes to finding the right mortgage rate, every little bit counts.

If you’re aiming for a specific monthly housing expense, now could be an ideal time for you to explore your options and see what kind of rate you qualify for.